When it comes to investing in the energy sector, the National Grid share price is a key topic of interest. With its essential role in the UK’s energy infrastructure, understanding how its stock performs can help you make informed decisions. In this guide, we’ll dive into what influences the National Grid share price and why it matters for investors like you.

What Is the National Grid?

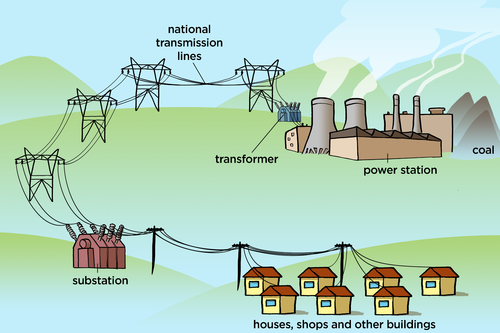

The National Grid is one of the largest electricity and gas utilities in the UK. It operates and maintains the transmission network, ensuring energy reaches homes and businesses across the country. Because of its vital services, it is considered a stable, long-term investment option.

Factors That Affect the National Grid Share Price

Several factors play a role in determining the National Grid share price. Below are some of the most important:

Economic Conditions

The overall health of the economy affects utility companies like National Grid. When the economy is strong, people and businesses use more energy, which can increase profits and boost the share price.

Energy Prices

Since the National Grid relies on energy production and transmission, changes in energy prices impact its financial performance. Rising energy prices can lead to higher revenues, making the share price more attractive.

Government Regulations

As a regulated utility, National Grid must comply with government policies. Any changes in regulations or price controls can directly impact the company’s earnings, and in turn, its share price.

Market Sentiment

Investor confidence plays a large role in stock prices. When investors believe in National Grid’s future prospects, they tend to buy more shares, pushing the price up.

The Importance of Tracking National Grid’s Stock Performance

Monitoring the National Grid share price can offer valuable insights into the company’s financial health and market position. For those looking to invest, tracking stock performance helps in making decisions about buying, holding, or selling shares.

Long-Term Stability

National Grid’s share price tends to show stability over the long term, making it an appealing choice for conservative investors seeking steady returns. It’s less likely to experience the high volatility seen in other sectors.

Dividend Payments

National Grid is known for paying regular dividends to its shareholders. These dividends can provide a steady income stream for investors. The dividend yield, however, is influenced by the share price. When the share price rises, the yield might decrease, and vice versa.

How to Buy National Grid Shares

Investing in National Grid shares can be done through various methods:

Stockbrokers: Many brokers offer easy access to National Grid’s shares, allowing investors to buy them directly.

ETFs and Funds: For those looking for a diversified approach, exchange-traded funds (ETFs) and mutual funds that include National Grid as a component can be a good option.

The Future of National Grid Share Price

Looking ahead, the future of National Grid’s share price largely depends on several evolving factors, including technological advances, energy transitions, and regulatory changes. With the global shift toward renewable energy, National Grid has been focusing on modernizing its infrastructure and adopting cleaner energy solutions. These initiatives could influence its long-term growth and stock performance.

Renewable Energy and Sustainability

National Grid has been working toward increasing its renewable energy capacity, including investments in offshore wind projects and electric vehicle infrastructure. As the world moves toward greener energy solutions, National Grid’s efforts to adapt to this shift could strengthen its market position. In turn, this could positively impact the share price over time.

Technological Innovations

Technological advancements in energy storage and smart grid technologies may also play a key role in boosting National Grid’s efficiency and profitability. As the company becomes more efficient in managing the energy grid and integrating renewable sources, its future outlook may look even more promising, attracting investors and potentially raising the share price.

Impact of Global Energy Trends

Global energy trends, such as the increasing demand for sustainable and reliable energy sources, will continue to influence National Grid’s operations and growth prospects. As energy security becomes a greater concern, National Grid’s role in ensuring a stable and resilient power supply will likely increase, making it a valuable company for investors to watch.

Risks to Consider Before Investing

While National Grid offers many benefits, there are also some risks to keep in mind when considering its share price.

Regulatory Risks

Being a heavily regulated utility company, any changes in government policies or price controls could impact National Grid’s revenue and profitability. Investors should stay informed about any legislative changes that could affect the company’s financials.

Market Risks

Analyzing National Grid’s stock may also be influenced by broader market trends. Economic downturns or shifts in investor sentiment can cause fluctuations in its share price, even though the company itself may remain stable.

Energy Price Volatility

Carabao Energy prices are a major factor for National Grid’s financial performance. Fluctuations in global energy markets, such as oil or natural gas prices, could impact the company’s costs and revenues. While National Grid can adjust some of these factors, major price swings may still affect its share price.

Why Should You Invest in National Grid?

Investing in National Grid offers several benefits:

Steady Growth: National Grid has a history of steady growth, which appeals to long-term investors.

Dividends: Investors can expect consistent dividends, making it an attractive option for income-focused portfolios.

Stability: As a key player in the energy sector, National Grid provides essential services, ensuring its position in the market remains strong.

Short FAQs About National Grid Share Price

Q: How often do National Grid shares pay dividends? National Grid typically pays dividends twice a year. The amount depends on the company’s financial performance.

Q: Is National Grid a good long-term investment? Yes, National Grid is generally considered a stable, long-term investment due to its steady growth and essential services.

Q: What is the impact of energy price changes on National Grid’s share price? Energy price changes directly influence National Grid’s revenue. Higher prices generally lead to better financial performance, which may boost the share price.

Q: Can National Grid’s share price fluctuate greatly? While National Grid’s stock is considered stable, it can experience short-term fluctuations due to market conditions or economic factors.

Understanding the National Grid share price is essential for making informed investment decisions. With its stable growth, regular dividends, and strong position in the UK’s energy infrastructure, National Grid continues to be an attractive investment for those looking for long-term gains. Keep an eye on factors such as energy prices, government regulations, and market sentiment to understand its future performance better.

UFC By investing in National Grid, you can benefit from its stability and potential growth in an essential sector of the economy.

To read more, Click Here

Leave a Reply