In an increasingly globalized economy, businesses require financial solutions that are efficient, cost-effective, and user-friendly. The Wise Business Account (formerly known as TransferWise) has emerged as a popular option for companies seeking to manage their international transactions seamlessly. This article explores the key features, benefits, and common questions surrounding the Wise Business Account, providing a comprehensive understanding of this financial tool.

What is the Wise Business Account?

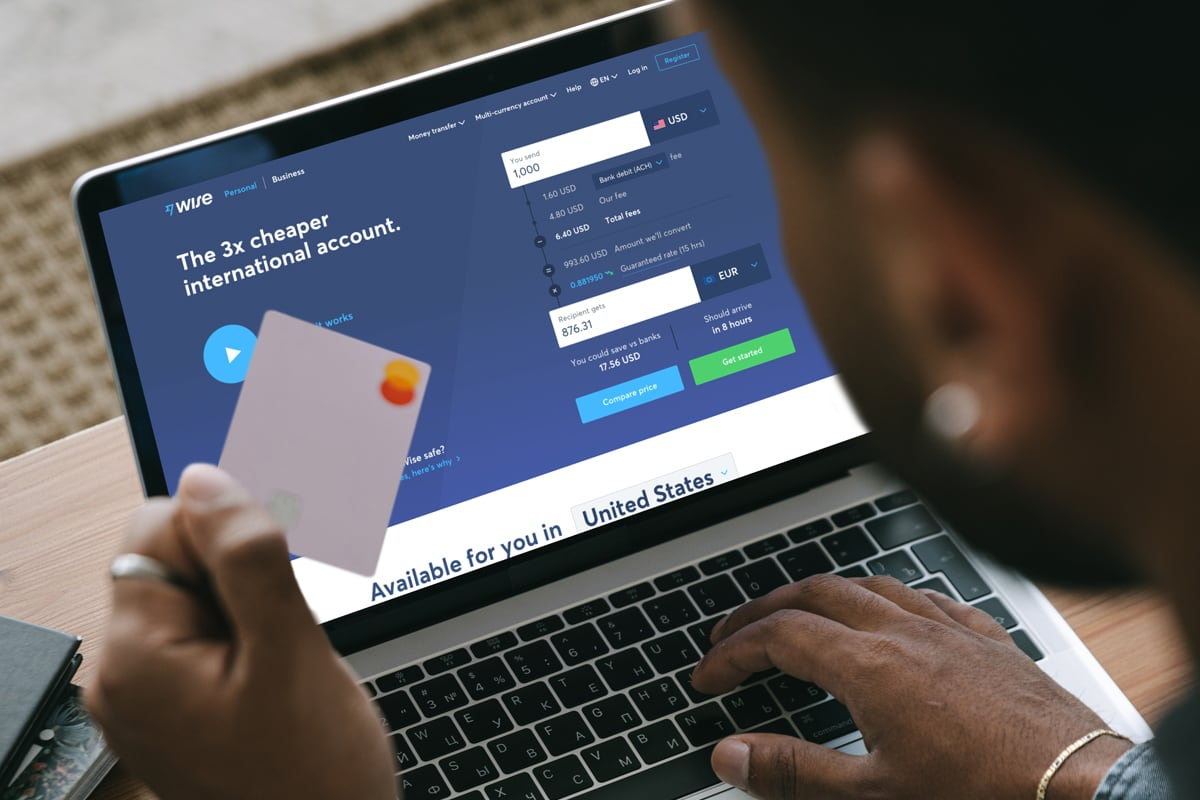

The Wise Business Account is a multi-currency account designed to help businesses manage their finances across borders. Founded in 2011, Wise has gained a reputation for its transparent pricing and low fees on international transfers. The platform enables businesses to hold and manage over 50 currencies, making it ideal for companies with international clients or suppliers.

Key Features of the Wise Business Account

Multi-Currency Holding

One of the standout Wise features of the Wise Business Account is its ability to hold multiple currencies. Businesses can receive, hold, and convert money in various currencies without the need for a traditional bank account in each country. This functionality allows companies to mitigate the risks associated with currency fluctuations.

Borderless Payments

The Wise platform simplifies the process of sending and receiving payments internationally. Businesses can make payments in the local currency of their suppliers or partners, reducing transaction fees and improving payment speed.

Low Conversion Fees

Wise prides itself on offering low conversion fees compared to traditional banks. They use the real exchange rate (the mid-market rate) for currency conversions, which is often more favorable than the rates provided by banks, allowing businesses to save money on international transactions.

Business Debit Card

The Wise Business Account comes with a debit card that allows businesses to spend directly from their multi-currency account. This feature is particularly useful for companies that need to make purchases in different currencies without incurring excessive fees.

Invoicing and Integration

Wise offers invoicing features that allow businesses to create and send invoices directly from the platform. Additionally, it integrates with various accounting software, streamlining the financial management process.

Multi-User Access

Businesses can add multiple users to their Wise Business Account, each with customizable permissions. This feature is beneficial for companies with multiple stakeholders who need access to financial data.

Benefits of Using a Wise Business Account

Cost Savings

One of the primary benefits of using a Wise Business Account is the significant cost savings it offers. Traditional banks often charge high fees for international transfers and unfavorable exchange rates. Wise, on the other hand, provides a transparent fee structure that allows businesses to see exactly what they are paying for each transaction.

Faster Transactions

Transactions through Wise are often completed faster than traditional bank transfers, especially for international payments. This speed can be crucial for businesses that rely on timely payments to maintain their operations and relationships with suppliers and clients.

User-Friendly Interface

Wise’s platform is designed with user experience in mind. The intuitive interface makes it easy for businesses to navigate their accounts, manage transactions, and access financial reports. This simplicity is especially beneficial for small to medium-sized enterprises (SMEs) that may not have dedicated financial teams.

Enhanced Security

Wise takes security seriously, employing industry-standard encryption and authentication measures to protect users’ data and funds. The platform is regulated by financial authorities in multiple jurisdictions, adding an extra layer of trust for businesses considering the platform.

Flexibility and Control

With the ability to hold and manage multiple currencies, businesses gain greater flexibility and control over their finances. This feature is particularly advantageous for companies that operate in various markets, allowing them to adapt to changing economic conditions quickly.

How to Open a Wise Business Account

Step 1: Sign Up

To open a Wise Business Account, businesses must visit the Wise website and click on the “Business” option. After selecting “Get Started,” users will be prompted to provide their email address and create a password.

Step 2: Verify Your Business

Once the initial sign-up is complete, users need to verify their business. This process typically involves providing documentation that proves the legitimacy of the business, such as business registration documents and identification for the business owners.

Step 3: Set Up Your Account

After verification, businesses can set up their multi-currency account. This step includes choosing the currencies they wish to hold and setting up payment methods.

Step 4: Fund Your Account

Once the account is set up, businesses can fund their Wise account using various methods, including bank transfers or credit/debit cards. They can then start making transactions immediately.

Common Questions About the Wise Business Account

Is Wise Safe to Use?

Yes, Wise is considered safe to use. The company employs strong security measures, including two-factor authentication and encryption. Additionally, Wise is regulated by financial authorities in the regions where it operates, adding to its credibility.

What Currencies Can I Hold in My Wise Business Account?

Businesses can hold over 50 currencies in their Wise Business Account, making it an ideal choice for companies with international operations. Some of the most commonly held currencies include USD, EUR, GBP, AUD, and CAD.

Are There Any Monthly Fees?

Wise does not charge monthly How to Send Money to the Philippines fees for its business accounts. Instead, it operates on a pay-as-you-go model, charging fees based on the transactions performed. This structure can lead to significant savings for businesses that frequently engage in international transactions.

How Long Do Transactions Take?

Most international transfers via Wise are completed within one to two business days. However, some transactions may be processed more quickly, depending on the currencies involved and the countries of origin and destination.

Can I Use Wise for Payroll?

Yes, businesses can use Wise to pay employees and contractors in different countries. This feature is particularly useful for companies with remote teams or those that hire international freelancers.

What Support Does Wise Offer?

Wise provides customer support through its help center, which contains a wealth of information on common issues and questions. Additionally, businesses can reach out to Wise’s customer support team via chat or email for more specific inquiries.

Conclusion

The Wise Business Account offers a modern solution for businesses looking to navigate the complexities of international finance. With its multi-currency capabilities, low fees, and user-friendly interface, it has become a favored choice among small and medium-sized enterprises. By understanding the features and benefits of the Wise Business Account, businesses can make informed decisions that enhance their financial operations and ultimately contribute to their success in the global marketplace. Whether you are a freelancer, a startup, or an established company, the Wise Business Account provides the tools necessary to manage your finances efficiently and effectively.

To read more, Click Here

Leave a Reply